Equipment Finance & Leasing

STV®CNC can offer you access to financing assistance via First Citizens Bank and other available lenders. Ready to finance essential equipment for your business? Click the link below to fill out your application.

Flexible financing options

Equipment financing or leasing can be affordable ways to get the new, used or custom-built equipment for your business. Plus, First Citizens Bank works with financing professionals who can help guide you through the process.

STV®CNC CUSTOMER: THOMPSON IRONWORKS

Get to know First Citizens Bank

First Citizens Bank Equipment Finance has more than 100 years of experience helping customers like you find financing options for business equipment. Learn more about what they do on the bank’s website:

STV®CNC CUSTOMER: MADNESS & METAL

Get to know Section 179

Being prepared for Section 179 of the IRS Tax Code can make a difference for your business. Follow this link to access a Section 179 calculator from First Citizens Bank Equipment Finance to help you explore potential future savings.

STV®CNC CUSTOMER: CLASS ACT FABRICATION

Grow your business on your terms

With over 100 years of experience working with small businesses, First Citizens Bank knows what it takes to start, expand and support your daily operations. They provide flexible small business loans and financing solutions to meet your needs.

STV®CNC CUSTOMER: TK1RACING

Business Financing Available

STV®CNC CUSTOMER: MONKEY BUSINESS WELDING AND FAB

Aside from Financing your STV®CNC Table purchase, you’ll have the opportunity to use your Approved Application to Finance other industrial equipment, vehicles for your business needs. First Citizens Bank has flexible, competitive financing options for your new, used or custom-built business equipment and vehicles. Their knowledgeable professionals will guide you through the process.

STV®CNC CUSTOMER: CHRISTIAN MANGANO

Competitive Rates & Flexible Terms for CNC Plasma Tables

Find the competive rates that fit your budget and benefit your shop’s production goals.

STV®CNC CUSTOMER: SMOKIN’ CHISEL

Competitive Rates & Flexible Terms for CNC Router Tables

Whether its small business, educational or corporate, financing can provide.

STV®CNC CUSTOMER: BLUE RIDGE METAL DESIGN

Competitive Rates & Flexible Terms for Hypertherm® Units

Plan for the future, as trusted advisors on board modify your application that fits you best.

Find out more about First Citizens Bank

Tap on the video below to find out more about First Citizens Bank.

Five reasons to finance

Five reasons to finance your next purchase. Getting the equipment you need is crucial for your business success — and waiting until you have cash in hand may not be the best option. Here are five reasons financing could be the solution for your equipment needs.

-

Get your equipment when you need it.

With financing, you can get the equipment you need now — and avoid making a hefty payment all at once.

-

Know what you’re paying each month.

You'll have a predictable monthly payment, which can help you plan for the future and budget for your other business needs.

-

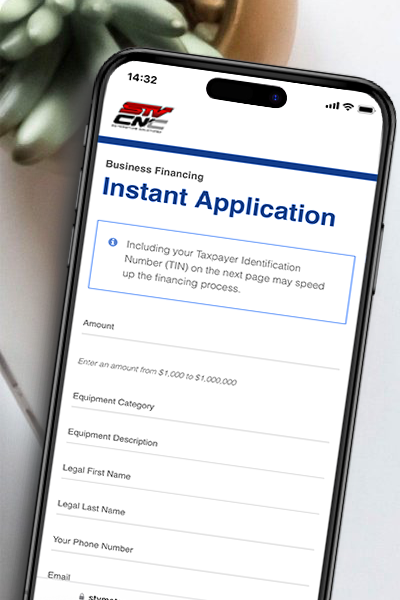

Financing is simple — and quick.

With our simple online application that you can complete in minutes, you could get quick turnarounds on approvals.

-

Keep your cash reserves available.

Paying for your equipment over time means you can avoid tying up your cash all at once.

-

Reap potential tax benefits.

Financed equipment could be deducted as an operating expense in the period in which it’s paid and put into use — and that could reduce your overall cost. Payments are also treated as expenses on the income sheet, so there’s no need to worry about depreciation.

Read more about First Citizens Bank.

How it Works

It’s quick and easy to apply online for financing. Click the button below to complete the secure application and receive a decision in as little as 3 minutes. Use your approval amount to purchase your new equipment.

Simple steps to get started

1. Apply online in as few as 3 minutes.

2. Sign your documents electronically.

3. Get your equipment.